Change in Pension Rules: Key Updates and Implications

Contents

Change in Pension Rules: Key Updates and Implications

Pensions are a vital part of post-retirement financial security, and any changes to pension rules significantly impact individuals planning for their future. Governments and organizations periodically revise pension rules to address economic, demographic, and fiscal challenges. Recently, significant changes in pension regulations have been announced, sparking debates and raising concerns among current employees, retirees, and policymakers.

Key Changes in Pension Rules

- Increase in Retirement Age

Many governments have increased the minimum retirement age to address longer life expectancies and reduce the financial strain on pension systems. This change aims to keep individuals in the workforce longer, thereby contributing to the economy and postponing pension payouts. - Revised Pension Calculation Formula

Changes in the formula used to calculate pensions are being implemented in some regions. These changes often involve factoring in longer average work years, lower inflation adjustments, or higher contribution requirements to ensure the sustainability of the pension fund. - Shift to Defined Contribution Plans

Employers increasingly favor defined contribution plans over traditional defined benefit plans. In defined contribution plans, the retirement payout depends on the contributions made by the employee and employer, along with investment performance. This shift transfers the investment risk from employers to employees. - Mandatory Contributions and Enhanced Savings

Some jurisdictions have introduced mandatory pension contributions for employees and employers, ensuring a steady inflow of funds to the pension system. Additionally, individuals are encouraged to enhance their retirement savings through supplementary schemes. - Reduction in Early Retirement Benefits

To discourage early retirement and extend workforce participation, new rules reduce or eliminate benefits for individuals opting to retire before the standard retirement age. - Digital and Automated Processes

Pension systems are becoming more automated, streamlining the application and disbursement process. Digital platforms ensure transparency, reduce errors, and provide real-time updates to beneficiaries.

Implications of the Changes

- Impact on Employees

Employees may need to work longer and save more during their active years to maintain their desired retirement lifestyle. These changes may particularly affect younger employees, who must adjust their financial planning strategies accordingly. - Challenges for Retirees

Current retirees could face reduced benefits or slower adjustments in line with inflation, potentially impacting their purchasing power. However, these changes are often phased in to minimize immediate disruptions. - Effect on Employers

Employers may experience reduced financial liabilities with the shift to defined contribution plans. However, they must also ensure compliance with new regulations and effectively communicate changes to their workforce. - Broader Economic Impact

Prolonging the working years of individuals can enhance productivity and economic growth. On the flip side, reduced early retirement options may affect job opportunities for younger workers.

Preparing for the Future

For individuals, adapting to these changes requires proactive financial planning. Key steps include:

- Understanding New Rules: Stay informed about the latest pension regulations and their implications on personal finances.

- Increasing Savings: Leverage supplementary retirement accounts and investment plans to build a secure financial future.

- Seeking Professional Advice: Consulting financial advisors can help optimize retirement strategies in light of regulatory changes.

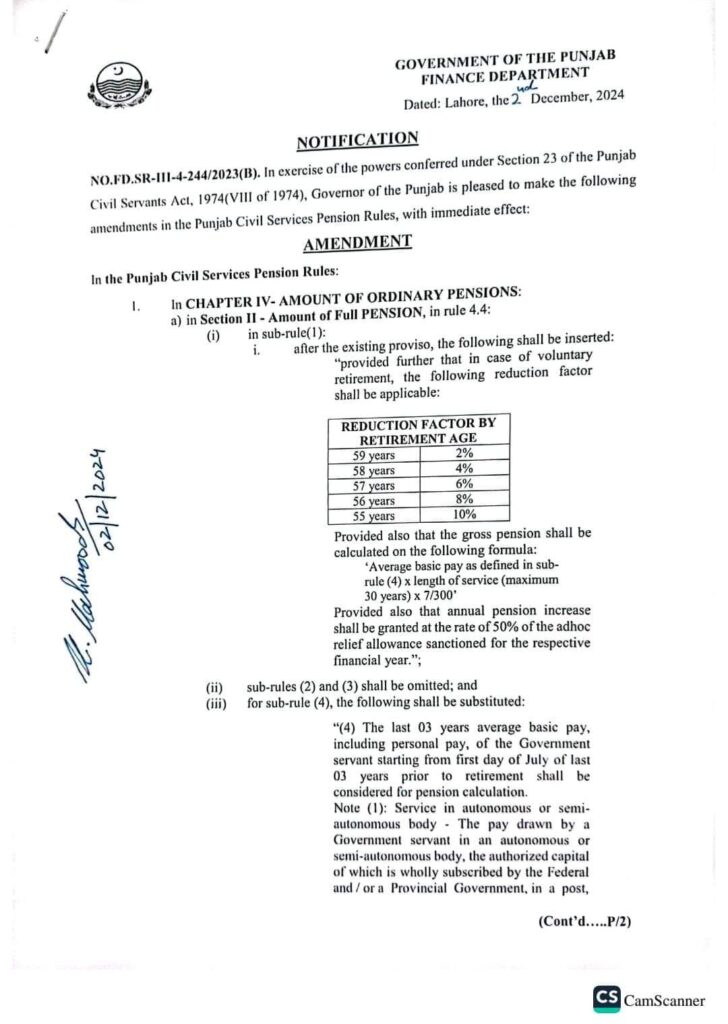

پنجاب فنانس ڈیپارٹمنٹ کی جانب سے جاری کردہ اس نوٹیفکیشن میں پنجاب سول سروسز پنشن رولز میں ترامیم کی گئی ہیں۔ ان ترامیم کے مطابق، والنٹری ریٹائرمنٹ پر پینشن میں کٹوتی کا نیا نظام متعارف کرایا گیا ہے، جس کے تحت 59 سال کی عمر پر 2%، 58 سال پر 4%، 57 سال پر 6%، 56 سال پر 8%، اور 55 سال پر 10% کٹوتی ہوگی۔ پینشن کی کیلکولیشن کے لیے ایک نیا فارمولہ دیا گیا ہے، جس میں اوسط بنیادی تنخواہ کو سروس کے سالوں (زیادہ سے زیادہ 30 سال) سے ضرب دے کر 7300 پر تقسیم کیا جائے گا، اور سالانہ پینشن میں 50% ایڈہاک ریلیف شامل ہوگا۔

فیملی پینشن کے قوانین میں بھی تبدیلی کی گئی ہے، جس کے مطابق فیملی پینشن صرف 10 سال یا دوبارہ شادی تک دی جائے گی۔ اگر بیوی یا شوہر موجود نہ ہوں تو لائف ٹائم پینشن دی جائے گی، اور اگر کسی سرکاری ملازم کی ایک سے زیادہ بیویاں ہوں، تو پینشن تمام بیویوں میں برابر تقسیم کی جائے گی۔ علاوہ ازیں، سول پینشن کی کٹوتی کے لیے نئی شرح 25% مقرر کی گئی ہے، جو پہلے “آدھا” کے طور پر بیان کی جاتی تھی۔ یہ ترامیم فوری طور پر نافذ العمل ہیں۔

حکومت پنجاب نے پنشن رولز میں 02.12.24 سے مندرجہ ذیل ترامیم کی منظور ی دے دی۔

1. 2011, 2015 اور 2022 سے ملنے والے اضافہ جات بند کر دئیے گئے ہیں

2. پنشن کیلکولیشن موجودہ بنیادی تنخواہ کی بجائے گزشتہ تین سال کی اوسط بنیادی تنخواہ کے مطابق ہو گی۔

3. رضاکارانہ طور پر ریٹائرمنٹ لینے کی صورت میں 2 فیصد سالانہ کٹوتی ہوگی

4. پنشن کیموٹیشن 25 فیصد تک لی جا سکے گی

5. فیملی پنشن 10 سال تک محدود کر دی گئی ہے

6. پنشن میں سالانہ اضافہ اس سال کے ایڈہاک ریلیف الاؤنس کا 50 فیصد ملے گا

Join Us On https://jobsgoro.com/

Join Our Whatsapp Group (Jobsgoro.com).

https://chat.whatsapp.com/CVwROiD9kKSFwq6pnIdQxi

Join Us On Facebook :

https://www.facebook.com/profile.php?id=100085051735597&mibextid=ZbWKwL