Understanding the Rate of Mark-Up on State Provident Fund

Contents

- 1 Understanding the Rate of Mark-Up on State Provident Fund

- 1.1 What is the Rate of Mark-Up on State Provident Fund?

- 1.2 Significance of the Rate of Mark-Up

- 1.3 Factors Influencing the Rate of Mark-Up

- 1.4 Impact of the Rate of Mark-Up on Contributors

- 1.5 How the Rate of Mark-Up is Determined

- 1.6 Historical Trends in the Rate of Mark-Up

- 1.7 Maximizing Returns from the State Provident Fund

- 1.8 Conclusion

Understanding the Rate of Mark-Up on State Provident Fund

The State Provident Fund (SPF) is a crucial financial instrument for many employees, providing them with a secure savings option that supports their long-term financial stability. Among the key factors that influence the attractiveness and viability of the SPF is the rate of mark-up, which directly impacts the returns on contributions made to the fund. In this article, we will delve into the concept of the rate of mark-up on the State Provident Fund, examining its significance, the factors influencing it, and how it affects the overall returns for the contributors.

What is the Rate of Mark-Up on State Provident Fund?

The rate of mark-up on the State Provident Fund refers to the additional percentage that the government adds to the base interest rate for the contributions made by employees. This mark-up rate is determined annually and can vary depending on various economic factors, including inflation, government policies, and the performance of the financial markets. The rate of mark-up is an essential component of the SPF as it determines the overall interest rate that contributors will receive on their savings.

Significance of the Rate of Mark-Up

The rate of mark-up is significant because it directly influences the returns that contributors will receive on their State Provident Fund savings. A higher mark-up rate means that contributors will earn more interest on their savings, thereby increasing the total amount available to them at the time of withdrawal. This is particularly important for employees who rely on their SPF savings for post-retirement financial security.

Factors Influencing the Rate of Mark-Up

Several factors influence the determination of the rate of mark-up on the State Provident Fund. These include:

- Economic Conditions: The overall state of the economy plays a critical role in determining the rate of mark-up. In times of economic growth, the government may be more inclined to offer a higher mark-up rate to encourage savings and investment. Conversely, during periods of economic downturn, the rate may be reduced to reflect the lower availability of financial resources.

- Inflation: Inflation is another significant factor that affects the rate of mark-up. Higher inflation typically leads to higher interest rates, including the mark-up on the State Provident Fund. This is because the government aims to ensure that the real returns on SPF savings remain positive, even in the face of rising prices.

- Government Fiscal Policy: The government’s fiscal policy, including its budgetary allocations and priorities, also impacts the rate of mark-up. If the government is focused on increasing public savings, it may offer a higher mark-up rate to incentivize contributions to the State Provident Fund.

- Market Performance: The performance of financial markets, particularly government securities and bonds, can influence the rate of mark-up. Strong market performance may enable the government to offer a higher mark-up, while weaker performance may result in a lower rate.

Impact of the Rate of Mark-Up on Contributors

The rate of mark-up has a direct impact on the returns that contributors receive on their State Provident Fund savings. A higher mark-up rate translates into higher interest earnings, which can significantly enhance the overall value of the savings over time. This is particularly beneficial for long-term contributors who can take advantage of the power of compound interest to grow their savings.

Conversely, a lower mark-up rate may result in lower returns, which could affect the financial security of contributors, especially those who are nearing retirement. It is, therefore, crucial for contributors to stay informed about the current rate of mark-up and how it may impact their long-term financial goals.

How the Rate of Mark-Up is Determined

The determination of the rate of mark-up on the State Provident Fund is a complex process that involves multiple stakeholders, including government agencies, financial experts, and economic analysts. The process typically includes the following steps:

- Economic Analysis: Government agencies conduct a thorough analysis of the current economic conditions, including inflation rates, market performance, and fiscal policy. This analysis helps to identify the appropriate mark-up rate that would balance the interests of contributors with the government’s financial capabilities.

- Consultation with Stakeholders: The government may consult with various stakeholders, including representatives of employee unions, financial institutions, and economic experts, to gather input on the proposed mark-up rate. This consultation process ensures that the final rate is fair and equitable for all parties involved.

- Approval and Announcement: Once the rate of mark-up has been determined, it is submitted for approval by the relevant government authorities. Upon approval, the rate is officially announced and communicated to contributors through various channels, including official gazettes, financial bulletins, and government websites.

Historical Trends in the Rate of Mark-Up

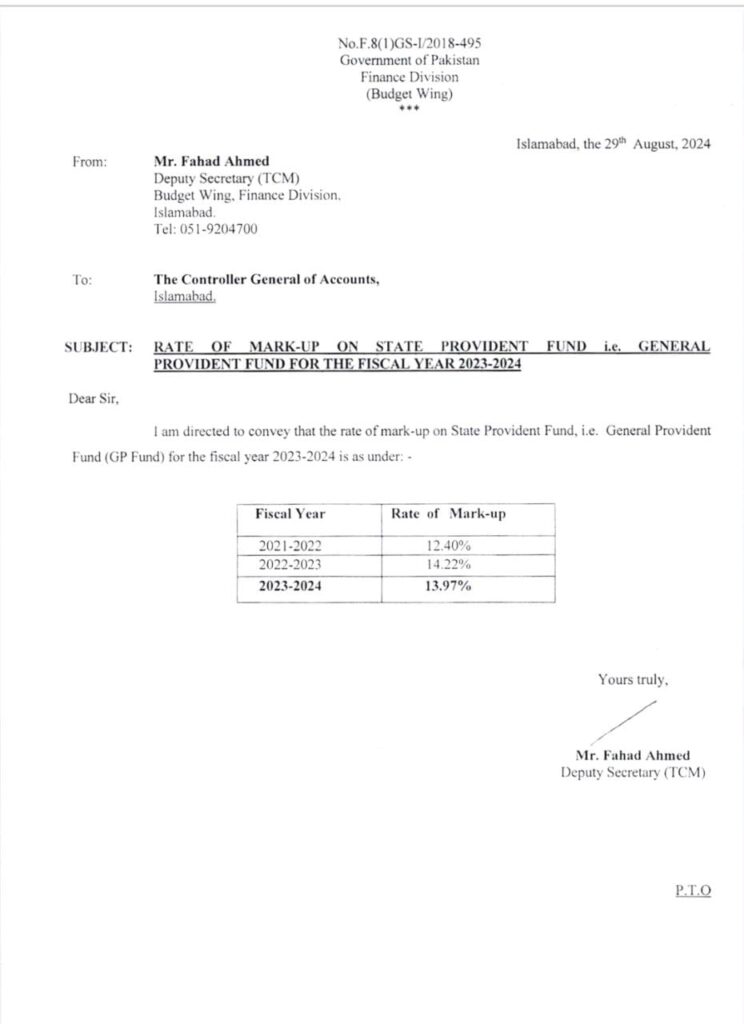

Over the years, the rate of mark-up on the State Provident Fund has fluctuated in response to changing economic conditions and government policies. Historically, periods of economic growth have been associated with higher mark-up rates, while economic downturns have seen reductions in the rate. Understanding these historical trends can provide contributors with valuable insights into how future mark-up rates may evolve.

Maximizing Returns from the State Provident Fund

To maximize the returns from the State Provident Fund, contributors should consider the following strategies:

- Regular Contributions: Making regular contributions to the SPF can help to take advantage of the compound interest effect, thereby increasing the overall value of the savings over time.

- Staying Informed: Contributors should stay informed about the current rate of mark-up and any changes that may affect their savings. This information is typically available through government announcements and financial news sources.

- Long-Term Planning: Contributors should adopt a long-term approach to their SPF savings, considering their future financial needs and retirement goals. This may involve setting specific savings targets and adjusting contributions accordingly.

Conclusion

The rate of mark-up on the State Provident Fund is a crucial factor that influences the returns on savings for contributors. By understanding how the rate is determined and the factors that influence it, contributors can make informed decisions about their SPF savings and maximize their financial security in the long run.

Join Us On https://jobsgoro.com/

Join Our Whatsapp Group (Jobsgoro.com).

https://chat.whatsapp.com/CVwROiD9kKSFwq6pnIdQxi

Join Us On Facebook :

https://www.facebook.com/profile.php?id=100085051735597&mibextid=ZbWKwL